Paying Way Too Much In Taxes?

Work with David Zubler, one of the most trusted tax experts!

Free ConsultationGet Your Free Copy of Crush the IRS

CRUSH THE IRS provides strategies that can save businesses thousands of dollars each year. It also provides strategies to write off exotic vacations, cruises, timeshares, cabins, beach houses, and motor homes. Many of the strategies can save thousands of dollars without spending any additional money. The book is written for people with very limited tax knowledge.

CLICK HERE

About David

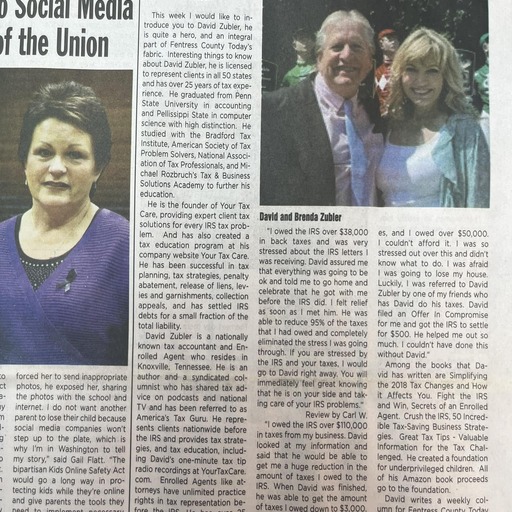

David is the firm’s founder, and an Enrolled Agent. Enrolled Agent status is the highest credential the IRS awards. Enrolled Agents like attorneys have unlimited practice rights in tax representation before the IRS. David graduated from Penn State in accounting and Pellissippi State in computer science with high distinction.

David has studied with the Bradford Tax Institute, American Society of Tax Problem Solvers, National Association of Tax Professionals and Michael Rozbruch’s Tax & Business Solution Academy to further his expertise in solving tax problems. He has over 25 years of experience in personal and business taxes, and is the author of six tax books.

Meet David

David C. Zubler

Enrolled Agent

A Message From Our Founder

Stressed About IRS Problems?

Are You Taking Advantage of

Tax Saving Strategies?

Here’s a certain truth: the State and Federal Government would love to have more of your hard-earned money in their accounts. Sure, even though it’s painful, none of us begrudge paying our legal and fair share of taxes.

But the problem is that regular taxpayers, like you, are missing out on legal and safe deductions, to the tune of hundreds of millions of dollars in unclaimed refunds every year!

Stop Overpaying-

We owed over $1,400 in tax penalties. David immediately told us he knew tax laws to take care of it. Fortunately, we contacted David before we paid the penalties and he was successful in having all of our penalties removed. We are so thankful we didn’t waste our money and turned to David instead.

Wade & Becky Stove -

Be careful who you let do your taxes. An attorney had recommended a tax preparer to me. The preparer did my 2014 tax return, and I ended up owing over $500. I didn’t have the money to pay my taxes so I just never filed them, and I dreaded doing my 2015 taxes. A friend spoke very highly of David C. Zubler and strongly recommended him. David did my 2015 taxes and then redid my 2014 taxes. I had expected to owe the IRS $500 again, but instead of owing over $1,000 for both years, David got me a combined refund of over $10,000. After David had finished my return, he even took the time to show me that everything he was doing was allowed in the Master Tax Guide. He even made me copies from the Master Tax Guide to take home. Anytime I have a tax question, David gives me the answer, and then takes the time to show it to me in Master Tax Guide and gives me a copy to take home. I am very thankful to have found him, and can’t recommend him highly enough.

Randi Cupp -

CRYING WITH HAPPY TEARS FOR ONCE!!! I appreciate you so much! So very much! You have worked so super hard for us. We are so grateful for you, for your help and your knowledge. We still don’t know how we got in this predicament with no way out. No one had answers and no one seemed to care. I have never prayed for anything so hard in my life. You cared about us and our situation. Thank you for caring! Thank you for helping! Feeling lighter and feeling like I can breathe again for the first time in years!!! Finally, we can move on to new chapters in our life. Forever grateful!

Whitney Kyte -

I got way behind on my taxes for six years and I owed over $58,000. I couldn’t do it. David Zubler filed an Offer In Compromise for me and got the IRS to settle for $250 for those years. It just helped me out so much. I couldn’t have done this without David. You’re awesome dude! Thank you.

Harry Fersner -

My wages had been garnished by the IRS. David called the IRS and was successful in getting them to agree to stop the garnishment. About a week later, I received a letter from the IRS which stated that David had been successful in stopping the garnishment. Unfortunately, the IRS did not contact my employer to let them know they should stop the garnishment of my wages as required by the agreement. When I discovered the IRS had continued to garnish my wages, I contacted David and he said he would immediately give them a call. He called the IRS but they gave him the run around and said the paperwork was going through different departments and it would take more time. They said garnishment would actually stop at a later date and that I was not entitled to get any of the garnishment back. David told me that he had attended a tax seminar and one of the speakers was the top person over the entire IRS Collections Division. He had told David that if he ever had any problems in dealing with the IRS, to give him a call on his cell phone. David said he would call him after his next appointment. David called him on his cell phone and the IRS fixed the problem with my employer immediately. And the IRS agreed that I would get back the money that was taken after the agreement had been accepted.

Ron Stoltzfus -

I had been receiving threatening letters by the IRS and owed over $25,000 in back taxes, and was afraid of having my wages garnished. After meeting with David, he assured everything would be ok. We offered the IRS $480, but during the process of the Offer in Compromise, I accepted a better paying job which caused the Offer to be rejected. David was tenacious in helping me and refused to accept the IRS rejection. David appealed the IRS decision, and my Offer was accepted. I am very thankful for David’s knowledge and experience in dealing with a complex case with the IRS. I am living in peace again.

Bart King -

I owed the IRS over $38,000 in back taxes and was very stressed about the IRS letters I was receiving. David assured me that everything was going to be ok and told me go home and celebrate that he got with me before the IRS did. I felt relief as soon as I met him. He was able to reduce 95% of the taxes that I had owed and completely eliminated the stress I was going through. If you are stressed by the IRS and your taxes, I would go to David right away. You will immediately feel great knowing that he is on your side and taking care of your IRS problems.

Nick Donaldson -

I owed the IRS over $113,000 in taxes from my trucking company. After looking at my information David assured me that he would be able to substantially reduce my taxes owed to the IRS. When David was finished he was successful in getting my taxes to the IRS down to $3,274.

Carl Wallace

Contact Us

Don't let taxes stress you out – contact us today for your free consultation! Discover the peace of mind that comes with having a trusted tax expert on your side.

(865) 357-4310

(865) 357-4310Suite 216A

Knoxville, TN 37923

(865) 363-3019

(865) 363-3019